#Bmo loan calc how to#

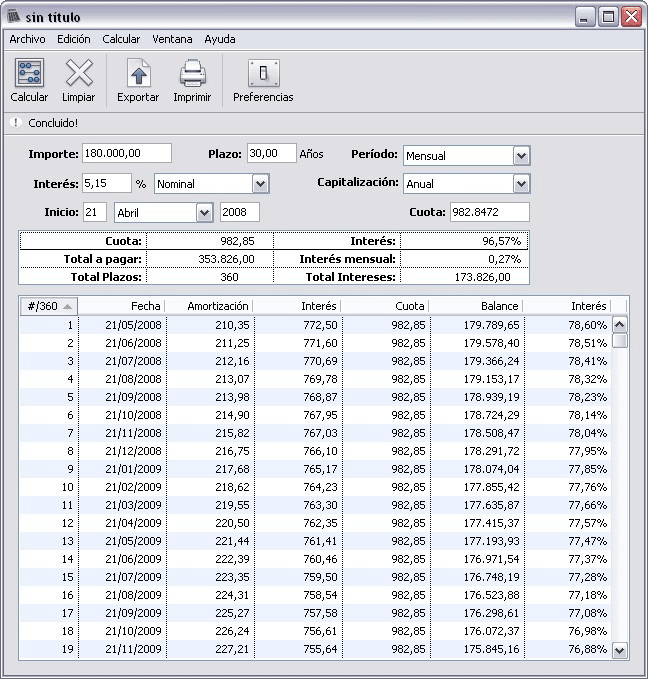

How to compare loans using the BMO loan calculator In this case, your estimated semi-monthly loan payment will be $286. Let’s assume you want to borrow $30,000 for a 5-year term at a 5.50% interest rate and make loan payments on a semi-monthly basis. To start the calculations, enter the loan amount between $5,000 and $9,999,999, the interest rate, select the payment frequency (monthly, semi-monthly, bi-weekly, or weekly), and specify the number of years you’ll need to repay your loan. This tool works best for personal loans that have fixed payment terms. By adjusting the amount to borrow and the loan term, you can see how your monthly payment changes. With the BMO loan calculator, you can estimate your regular payments based on the loan amount you apply for, interest rate, payment frequency, and the number of years you need to pay back your loan. Investment Payout Calculator to estimate an expected income from your investments based on different payout options TFSA Calculator to estimate your potential savings from investing with a Tax-Free Savings AccountĬontinuous Savings Plan Calculator to get an idea of how much you could save based given a certain regular contribution amount and frequency RIF Payment Calculator to get an understanding of what to expect from your RIF/LIF payments RRSP Calculator to get an idea of what you can expect to have saved by the time you retire Mortgage Protection Insurance Calculator to estimate your insurance premiums based on the selected insurance coverage options Mortgage Prepayment Calculator to estimate prepayment charges you may face when repaying your mortgage before the maturity date Mortgage Affordability Calculator to see how much you can afford to borrow given your annual income, monthly expenses, and the down payment you can make Mortgage Payment Calculator to see what your regular mortgage payments will look like based on a property’s purchase price, your down payment, term, interest rate, amortization period, and payment frequency Loan Calculator to get an idea of what your loan payments could look like based on the loan amount, interest rate, payment frequency, and amortization periodīusiness Loan Calculator that works exactly the same way as a personal loan calculator As long as lines of credit don’t involve any fixed term to repay your debt, the BMO loan calculator won’t be the most illustrative solution for this lending option. With the BMO loan calculator, you can enter the total amount you want to borrow, interest rate, payment frequency, and amortization period and see the approximate loan payment amount. To help clients get a better understanding of their estimated loan payments, BMO has provided a loan calculator on its website.

You can apply for all of these loan options online - no need to visit a branch in person. A line of credit can be both unsecured and secured with personal assets like your home. For ongoing borrowing needs, BMO offers more flexible credit tools - lines of credit starting at $5,000. If you are looking for a larger borrowing amount and are ready to secure your loan with a personal asset, consider a home equity loan from BMO starting at $10,000 in financing. For clients looking to borrow an exact amount and pay it back on a set schedule, BMO Bank offers unsecured personal loans starting from $5,000 in financing.

0 kommentar(er)

0 kommentar(er)